10

AgustusExploring Online Lines of Credit with No Credit Check: A Financial Lifeline for a Lot Of

In today’s quick-paced world, financial emergencies can arise unexpectedly, leaving individuals scrambling for instant solutions. For a lot of, conventional lending options often come with stringent necessities, together with credit checks that may disqualify potential borrowers. If you liked this article therefore you would like to obtain more info relating to get a loan instantly no credit check i implore you to visit our web-page. Nevertheless, the emergence of online lines of credit with no credit check is reworking the borrowing landscape, providing a financial lifeline for many who may in any other case struggle to access funds.

Understanding On-line Strains of Credit score

An online line of credit is a flexible borrowing choice that allows shoppers to withdraw funds up to a predetermined restrict, repay them, and borrow again as wanted. This revolving credit might be notably advantageous for managing money movement, protecting unexpected expenses, or making important purchases. In contrast to traditional loans, which offer a lump sum that should be repaid in mounted installments, lines of credit score provide borrowers higher flexibility in how and after they use their funds.

The Attraction of No Credit Check

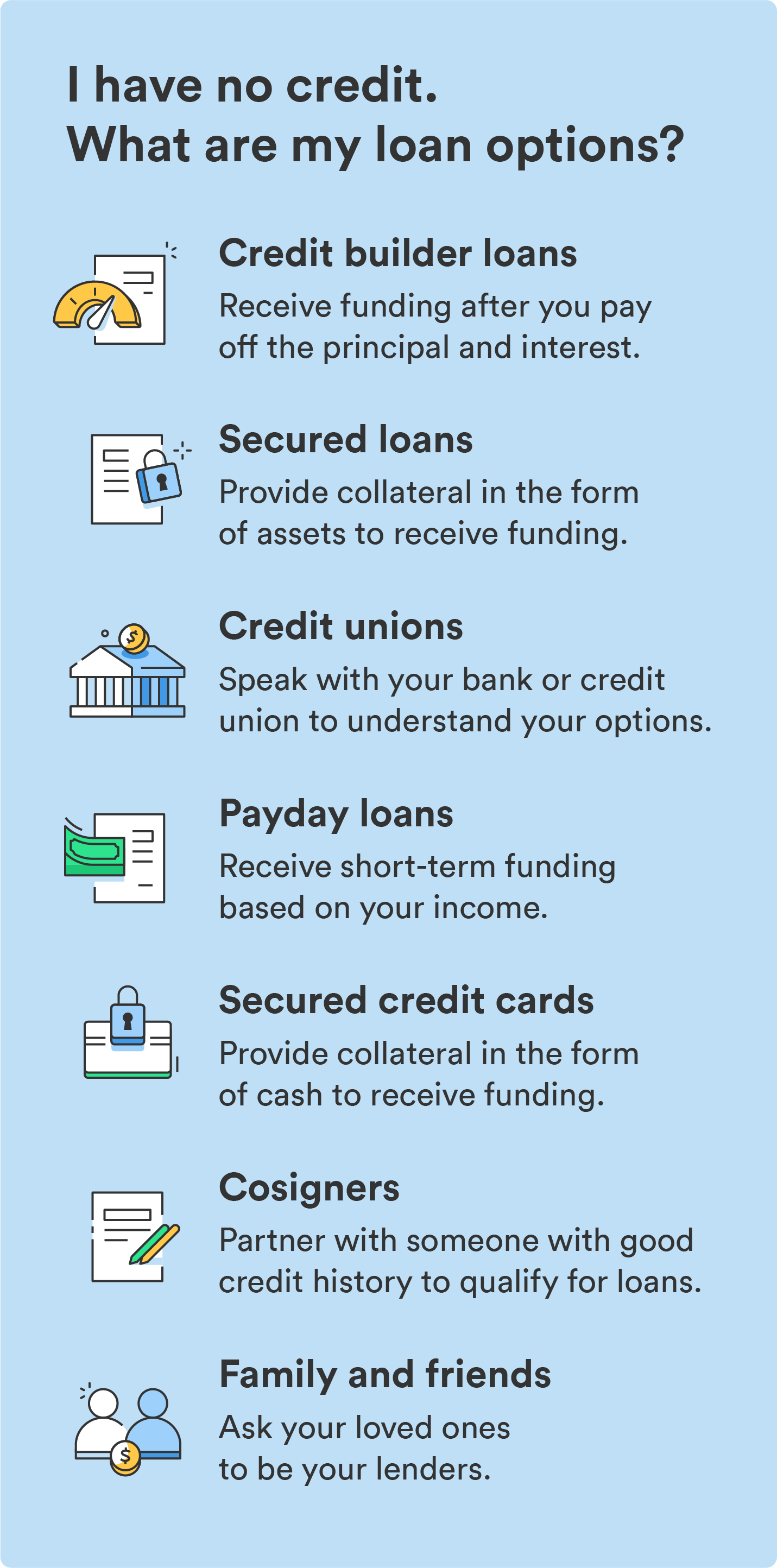

The primary draw of online lines of credit with no credit check is accessibility. Many people face challenges in terms of their credit score history—whether because of past financial errors, lack of credit history, or just being new to the country. Traditional lenders often use credit score scores as a main consider determining eligibility, which might go away many consumers in the lurch. Online lenders providing no credit check choices provide an alternate, permitting borrowers to entry funds without the fear of being turned away as a consequence of their credit score rating.

How It works

The process for obtaining a web based line of credit with no credit check is often streamlined and consumer-friendly. Borrowers can apply by a lender’s webpage, filling out a simple software that requires basic personal info, earnings details, and banking information. Some lenders might also request proof of employment or income to assess the borrower’s ability to repay the loan.

Once the applying is submitted, lenders quickly evaluation the information supplied. Without the necessity for a credit score check, approvals may be granted within minutes, and funds will be deposited instantly into the borrower’s checking account shortly thereafter. This pace and comfort are significantly appealing for these dealing with pressing financial needs.

Pros and Cons of No Credit Check Strains of Credit score

Whereas some great benefits of online lines of credit with no credit check are vital, it’s important to think about the potential drawbacks.

Professionals:

- Accessibility: These strains of credit can be found to individuals with poor or no credit historical past.

- Larger Interest Rates: Lenders might cost increased interest rates for no credit check options, reflecting the elevated danger they take on by lending to people with less established credit score histories.

Responsible Borrowing Practices

For people contemplating a web based line of credit score with no credit check, it’s crucial to strategy borrowing with caution. Listed here are some accountable practices to keep in mind:

- Assess Your Wants: Before applying, consider whether or get a loan instantly No credit Check not you genuinely want the funds and the way a lot you require. Keep away from borrowing greater than vital.

The way forward for No Credit Check Lending

As the demand for accessible monetary solutions continues to develop, the marketplace for get a loan instantly no credit check online lines of credit with no credit check is likely to expand. Expertise is enjoying a major position in this evolution, get a loan instantly no credit check with many lenders leveraging different data sources to evaluate creditworthiness. This approach permits lenders to make more knowledgeable choices with out relying solely on traditional credit scores.

Moreover, as financial literacy improves among shoppers, people have gotten more conscious of their borrowing options and the significance of managing their credit score responsibly. This shift may result in extra responsible borrowing practices and a greater understanding of the implications of taking on debt.

Conclusion

Online lines of credit with no credit check current a viable solution for a lot of individuals going through monetary challenges. By providing quick access to funds without the barriers of traditional credit checks, these lending choices empower borrowers to handle their finances extra successfully. Nonetheless, as with any monetary product, it is important for consumers to strategy these traces of credit score with warning, understanding the terms and committing to accountable borrowing practices. Because the panorama of lending continues to evolve, it's crucial for borrowers to remain informed and make choices that align with their financial targets.

Reviews